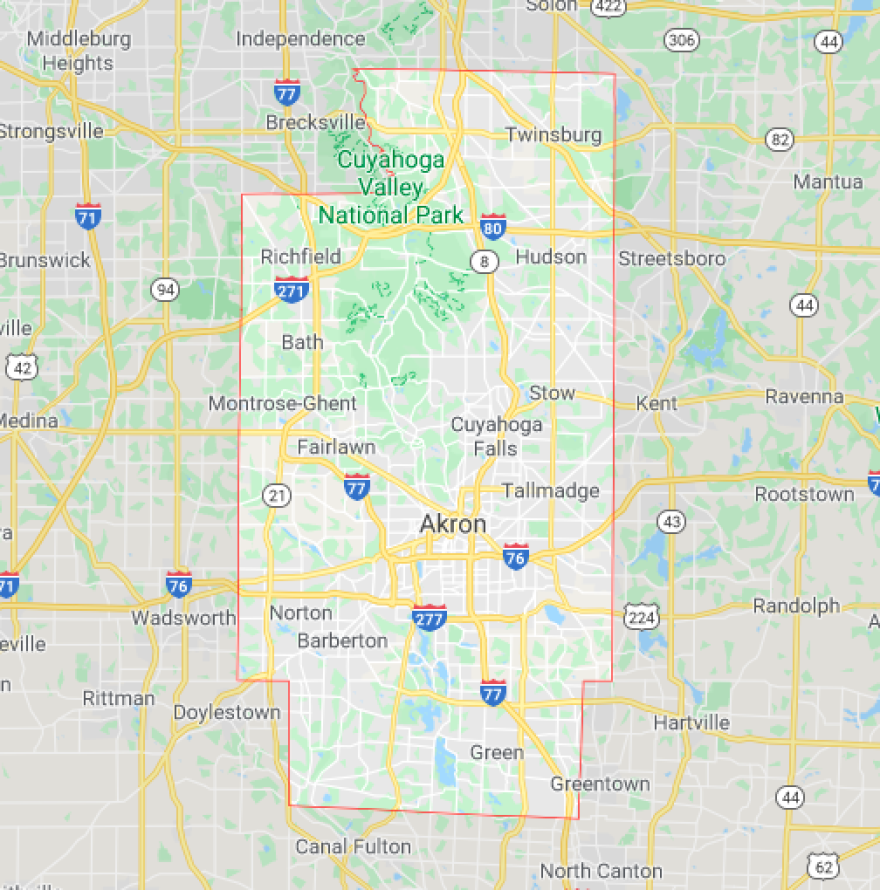

Property owners in Summit County have until March 31 to challenge the new valuation of their property.

The released new property values in December following appraisals as required by Ohio law. However, this time, State Tax Commissioner Jeff McClain mandated the office only use 2019 sales during their reappraisal rather than sales from the past three years, leading to a large increase in property values.

Deputy Fiscal Officer Dominic Basile says this does not necessarily mean there will be a significant rise in property taxes.

“If your property value went up 20%, your actual real estate taxes would most likely not go up 20%. It would be to a lesser degree,” Basile said.

He says there’s even a chance property taxes won’t go up at all on properties whose value went up.

Property owners can appeal to the if they feel their new valuation was too high or too low.